We are invested investors

Mérieux Equity Partners is one of the most recognized and active European Investment firms in the Healthcare sector.

We support the development and growth of high-potential companies from business launch to large scale deployment through capital investment and tailor-made support based on our strong sector expertise and international network.

We are an agile investor with a flexible approach in terms of minority or majority stakes.

Our main focus is partnering with and investing alongside management teams.

What makes us different?

01

We are specialized in Healthcare

02

We are powered by Institut Mérieux

03

We have a solid track-record of supporting development and growth stories

04

We have two complementary teams - Venture Capital and Buyout

05

We have a supportive approach with entrepreneurs and managers

Venture Capital

Our investment strategy:

- Where: Europe (sweet spot) - United States (opportunistic)

- When: From Seed to Late VC

- Team : 5 investment professionals

- Syndication : Lead/Co-lead

- Locations : Lyon & Paris

- How much : €4m to €10m

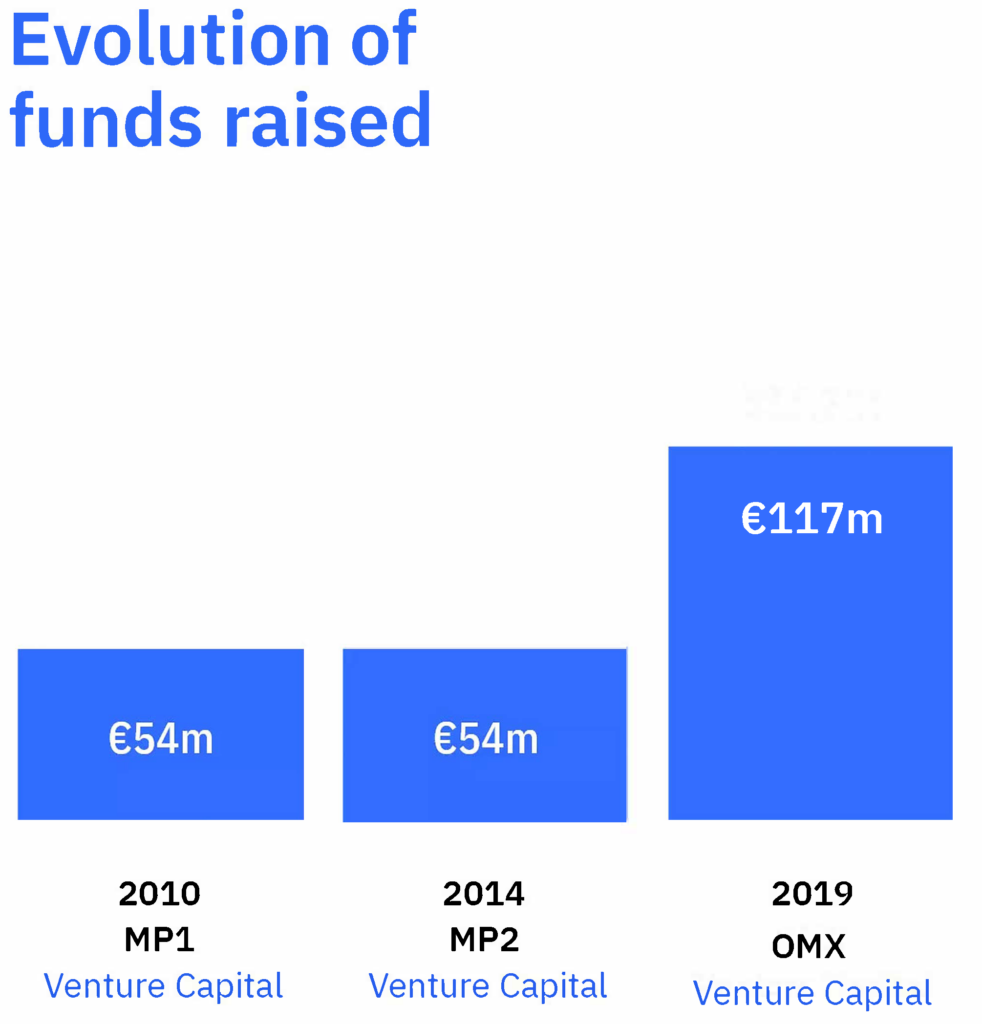

With combined operational and investment experience in healthcare sector, the team is focusing on disruptive technology to bring transformative medical solutions to the patient. Since 2010, we invested in more than 25 companies, mainly in Europe (sweet spot), and the United States (opportunistic). Our active Venture Capital fund (OMX FPCI) is covering 4 Healthcare subsegment (Diagnostic & Therapeutic Platforms, Life Science Tools, Medical Devices, Pharma Services), invested in 12 companies so far. From seed to late venture, we support and strengthen the development and growth of the most promising European companies by supporting entrepreneurs across the entire development path. Our team and large network is bringing decades of experience in product development, manufacturing, regulatory and clinical affairs, intellectual property, as well as human resources management.

How we co-create value ?

We have partnered with experts and organizations throughout the innovation chain to provide comprehensive support to entrepreneurs at all stages of development. Our mission is to identify and select the most promising companies for helping them successfully grow their impactful business. We believe that our partnership approach combined with our industrial network sets us apart as early stage investors, enabling us to provide unparalleled support to our entrepreneurs.

Through M2care, initially a French services company launched in 2017 dedicated to leverage health innovation, and which became a European startup studio in 2023.

Funds under management

OMX Europe Venture Fund (2020) - Investment phase

Fund size

Total number of portfolio companies

Investment range

Number of active companies in the portfolio

Mérieux Participations 1 (2009) - Exit phase

Fund size

Total number of portfolio companies

Investment range

Number of active companies in the portfolio

Mérieux Participations 2 (2014) - Exit phase

Fund size

Total number of portfolio companies

Investment range

Number of active companies in the portfolio

Funds with advisor mandate

Pertinence Invest 2 (2020) - Investment phase

Fund size

Total number of portfolio companies

Investment range

Number of active companies in the portfolio

*Pertinence Invest 2 is managed by UI Investissement, Merieux Equity Partners acts as advisor for healthcare investments

Pertinence Invest 2 (“PI2”) is a seed fund launched in 2020 by UI Investissement (formerly Sofimac Innovation), in partnership with leading French engineering schools and universities. It focuses on Industry 4.0, new energies, new materials, digitalization, and disruptive platforms serving the health and nutrition sectors. This program brings together an entire ecosystem including some of France’s largest industrial companies (bioMérieux, Michelin, Seb, etc.) and supports startups directly from the research laboratories of its university partners or in direct relation with them.

Mérieux Equity Partners advises UI Investissement on investments in the healthcare and nutrition sectors for this fund. The fund’s strategy is to invest in highly innovative companies and leading platforms in early development stage with investments ranging from €0.3 million to €3 million.

- Venture Capital

- Other news

- Venture Capital

- Other news

Quotes from portfolio companies’ CEOs’

MxEP has proven to be a decisive support in refining our economic model and our roadmaps [...] and a valuable partner in the financing process. It has also been equally valuable in the daily development of our company, by opening up its network of experts and offering us its full cooperation to navigate all key stages

“Thanks to their insight and intelligence, the members of Mérieux Equity Partners provide more than critical funding to high-tech companies. They guide us in our strategic positioning and share their experience in development and commercialization to ensure our success. They anticipate industry developments and facilitate the journey of companies to help them achieve their objectives.”

Buyout

Our Buyout team invests, majority or minority, in profitable and fast-growing European companies to support their projects and development

Supporting Healthcare development

Our investment strategy:

- Geographies: Europe

- Company profile: Fast-growing and profitable companies

-

Equity ticket: €20m to €80m

(more with co-investment) - Locations: Paris & Lyon

- Team: 10 investment professionals

- We invest in in profitable and fast-growing European companies to support their projects and development.

- We cover the whole Healthcare sector, with our 6 sub-segments: Pharma, Pharma services, Patient services, MedTech, Life science tools & diagnostic, and Preventive medicine.

- We can do either buyout transactions or growth financing, take majority or minority stakes, and operate with or without leverage at entry.

- We are active shareholders and support organic or M&A strategies alongside the Management teams we accompany.

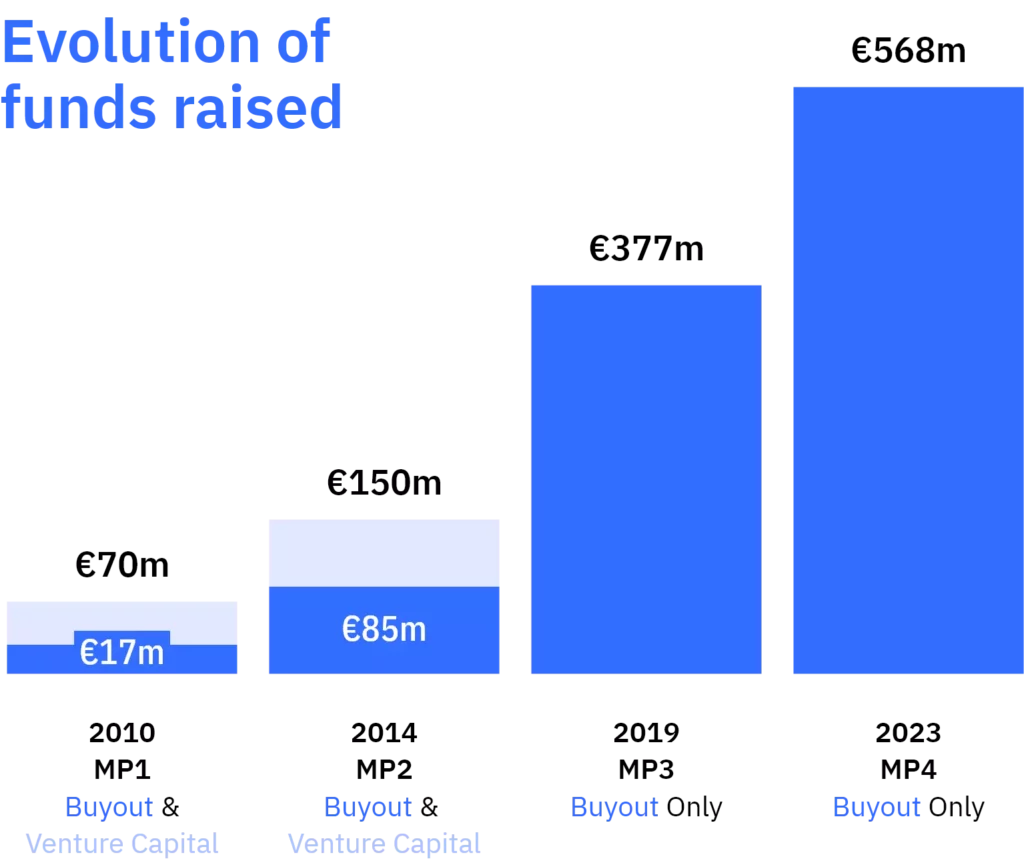

- Our first vehicle (MP3), closed at €377m in 2019, was invested in 12 companies in France, Italy, Belgium, and Sweden.

- Our second vehicle (MP4), closed at €568m in 2023, is already invested into 9 companies in France, Switzerland, Belgium, Finland, and the Netherlands.

- As responsible investors, we systematically integrate ESG criteria in our investment process and monitoring.

- Buyout

- Recent investments & divestments

Quotes from portfolio companies’ CEOs’

“The Mérieux Equity Partners team has been instrumental in helping us building GTP Bioways as a truly comprehensive CDMO platform for biologics, antibody-drug conjugates and nanodrugs. The support of MxEP has also been critical for value creation, including capacity expansion towards new, promising lines of businesses and selective M&A in key bolt-on services"

“We are extremely pleased about Mérieux Equity Partners becoming a shareholder of reference since, in addition to fully sharing our ethical values and innovation spirit, they provide us with active support on our international development. This will enable us to continue our great adventure in the sole interest of patients”

“I am very pleased and proud to have Mérieux Equity Partners alongside us as shareholder since 2014. Since then, MxEP has demonstrated its ability to be an added-value partner for CEVA with concrete support on critical topics (M&A strategy; biological product manufacturing reinforcement; international development), and by also allowing us to leverage the long history of industrial expertise and long-term vision of Mérieux Family”